QR payments replacing cards globally

In a world where digital transactions are as common as cash used to be, the fintech industry faces a significant hurdle: enabling safe, fast, and secure cross-platform payments. Initially, Bitcoin emerged as a promising solution, but its appeal to investors led to increased transaction costs and speeds unsuitable for everyday payments. In contrast, traditional players like MasterCard and Visa complete transactions in seconds, setting a high standard for user expectations.

Enter Ripple, a company often known for its cryptocurrency, XRP. While many recognise Ripple in the context of digital currencies, its true potential lies in its application for banks and money transfer companies. Ripple's technology has proven to be a game-changer in transaction speed and cost efficiency. Unlike Bitcoin transactions, which can take up to 30 minutes, Ripple processes transactions in just a few seconds. Additionally, Ripple's transaction cost is astonishingly low, at about 5 cents.

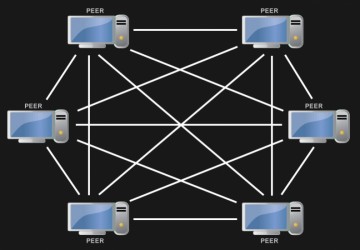

This efficiency positions Ripple as a formidable contender to challenge the dominance of payment giants like MasterCard and Visa. The core of this revolution lies in the integration of QR payments. QR codes are already prevalent in mobile banking and digital wallets. By incorporating Ripple's system, payment providers can achieve compatibility for near-instant payments across different platforms.

Ripple's innovation doesn't stop at speed and cost. It introduces "Tags" in transactions, allowing for the transmission of additional data like client account numbers or specific identifiers. This feature enhances transaction security and user identification, making Ripple's system fast and smart.

One of Ripple's most notable advantages is the minimal exposure to cryptocurrency or exchange rate volatility due to the rapid processing of transactions. This stability is crucial for both users and providers in the fintech space.

The future of fintech could be significantly impacted if more providers adopt a multi-platform compatible QR code system with minimal integration requirements. Such a move would foster greater collaboration and pave the way for global expansion in the payments and fintech industry.

Ripple's approach to digital transactions illustrates a pivotal shift in the fintech landscape. By offering a solution that is both efficient and cost-effective, Ripple is not just competing with established payment networks; it is setting a new standard for the future of banking, payments, and digital wallets. As the industry evolves, Ripple's role in shaping the future of digital transactions becomes increasingly clear - fast, secure, and universally accessible payments are not just a possibility; they are on the horizon.

Date: January 20, 2024

Author: Cameron McKean – CEO Founder Confidia Limited.

-

07/03/2024 315

07/03/2024 315 -

07/03/2024 369

07/03/2024 369 -

07/03/2024 415

07/03/2024 415 -

06/16/2024 405

06/16/2024 405 -

06/16/2024 370

06/16/2024 370

-

06/10/2017 5455

06/10/2017 5455 -

06/19/2017 4127

06/19/2017 4127 -

10/07/2017 4084

10/07/2017 4084 -

06/10/2017 3981

06/10/2017 3981 -

06/28/2017 3613

06/28/2017 3613

FEATURED NEWS

GENERAL

GENERAL

GENERAL

GENERAL

LEAVE A COMMENT