The Persistent Challenge of the Unbanked in 2024: A Call for Inclusive Banking

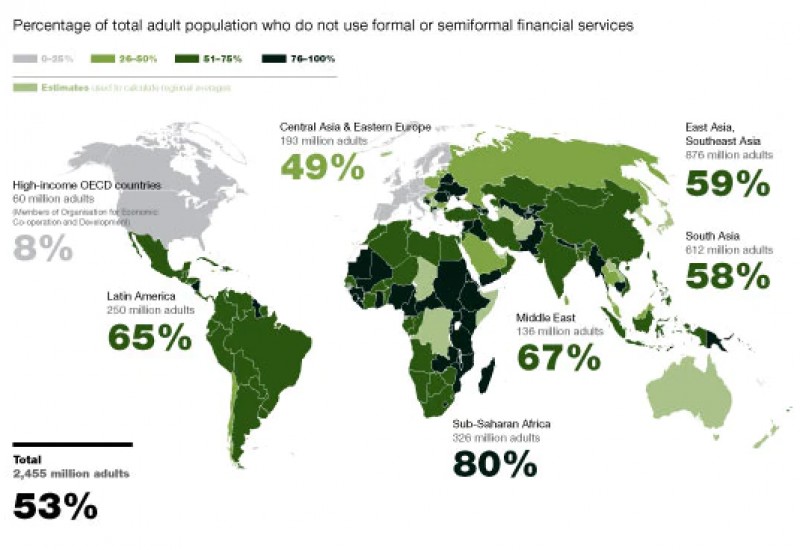

As we step into 2024, the issue of the unbanked remains a glaring challenge, particularly in many Asian countries. Despite the advancement and modernization of banking systems across these regions, a significant portion of the population still finds themselves excluded from these financial networks. This predicament is intricately linked to the socio-economic dynamics within these countries, notably concerning migrant workers, who form the backbone of several key industries like construction and manufacturing.

The Plight of Migrant Workers in the Banking System

The core of the unbanked problem lies with migrant workers, who often struggle to fulfill the criteria for opening bank accounts in their host countries. Many of these workers resort to low-paid jobs, largely due to a lack of proper documentation or educational qualifications. From a banking perspective, these individuals are seen as less desirable clients, primarily due to their low savings, modest income, and the tendency to withdraw all funds soon after deposit. This perception aligns with the business models of traditional banks, which find little financial incentive in catering to this segment.

Regulatory Hurdles Exacerbating the Issue

The situation is further complicated by stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These policies, while crucial for preventing financial fraud and money laundering, inadvertently raise the barriers for migrant workers to access banking services. The compliance requirements often surpass what these workers can provide in terms of documentation and financial history.

A Beacon of Hope: Neo-Banks and Fintech Innovations

Nevertheless, there is a ray of hope in this bleak landscape. The emergence of neo-banks and Fintech providers is beginning to address this gap. These modern financial institutions are designed to operate with lower overheads and are more agile in adapting to the needs of diverse client bases, including the unbanked. By leveraging technology, especially the widespread use of smartphones, these entities are uniquely positioned to offer banking and financial services to those traditionally excluded.

The Future of Banking: Inclusion and Accessibility

The advent of these new players in the banking sector brings with it the promise of significant changes. The goal is not just to provide basic banking services but to ensure that these services are accessible, affordable, and relevant to the needs of the unbanked population, particularly migrant workers. The vision is to transform access to a bank account from a privilege to a fundamental right.

The Road Ahead

The journey towards inclusive banking is certainly challenging, but the advancements in technology and the entry of innovative financial players offer a glimmer of hope. There's optimism that soon, the most financially underserved groups will gain access to the banking and financial services they so crucially need. Until then, the problem of the unbanked remains a critical issue that needs continued attention and innovative solutions. The ultimate aim is to ensure that everyone, irrespective of their socio-economic background, can enjoy the benefits of a secure and inclusive financial system.

What's your reaction?

Comments

Leave a Reply