Diversifying Across Top-Tier Cryptos (Made Easy?)

Market Overview (Aug 2024 – Aug 2025)

Over the last 12 months, the cryptocurrency market experienced a strong rally led by established high-cap projects. Bitcoin’s long-anticipated 2024 halving and improving sentiment (e.g. the election of a pro-crypto U.S. President) helped spark a broad uptrendeconomictimes.indiatimes.comeconomictimes.indiatimes.com. Bitcoin itself shattered records in late 2024, breaking above $100,000 for the first time and closing 2024 up ~136% (adding over $1.2 trillion to its market cap)economictimes.indiatimes.combinance.com. By August 2025 Bitcoin traded around $112K per coin (market cap ~$2.23 trillion)zebpay.com – roughly 3–4× higher than its price a year prior. Importantly, altcoins (major non-Bitcoin crypto assets) far outpaced Bitcoin’s growth in percentage terms. The total crypto market capitalization roughly doubled during 2024 (from under $1.8 trillion to $3.6 trillion)binance.com, and 2025 continued this trend as many leading tokens pushed to new highs. This environment rewarded strategies that spread investments across established blockchain tokens, not just Bitcoin.

Note: Some meme-based coins saw explosive gains in this period (for example, one meme token surged over 1,500% in 2024economictimes.indiatimes.com, and Dogecoin climbed ~333%economictimes.indiatimes.com). However, these “meme coins” are highly speculative and not grounded in fundamentals, so they are excluded from our strategy. We focus only on well-established blockchains and tokens with real usage.

Diversifying Across Top-Tier Cryptos

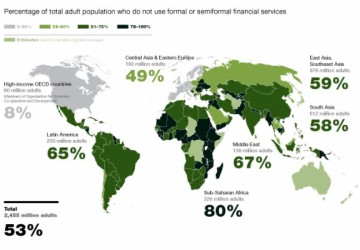

A diversified, equal-weight investment across a wide range of ~100 top cryptocurrencies would have been a very successful strategy in Aug 2024–Aug 2025. By investing equally in a broad basket of the largest market-cap coins (excluding memes), an investor ensures exposure to all major sectors – from store-of-value (Bitcoin) and smart contract platforms (Ethereum, Solana, etc.) to payment networks (Ripple, Stellar) and DeFi infrastructure tokens. This approach spreads risk and captures the outsized gains of top performers without needing to predict exactly which token will moon. In practice, Bitcoin and Ethereum provided a stable backbone (with substantial, if lower, returns), while many altcoins delivered multiples of growth, lifting the entire equal-weighted portfolio’s return. Crucially, an equal-allocation strategy outperformed a market-cap weighted approach – because smaller established alts with huge rallies aren’t underweighted. Essentially, the strategy is akin to holding a crypto index of the top 100, which benefited from the broad market boom and the extraordinary runs of certain coins.

For example, an investor who split their funds evenly across 100 leading cryptos in Aug 2024 would have held all the major Layer-1 chains (ETH, BNB, ADA, SOL, etc.), Layer-2s and new protocols, exchange tokens, payment coins, and DeFi project tokens. As the bull run unfolded, multiple holdings in this basket far outperformed Bitcoin’s ~136% yearly gainbinance.com. These high flyers pulled up the portfolio’s overall performance. Meanwhile, the coins that lagged or had modest growth had a limited negative impact due to their small equal weight. By avoiding meme coins and sticking to established projects with real user bases, the portfolio also minimized the chance of catastrophic crashes or rug-pulls. In summary, broad diversification in quality crypto assets was an excellent strategy to maximize risk-adjusted returns during this period.

Top Gainers Among Established Tokens

Within an equal-weighted portfolio of top cryptos, the best returns came from certain altcoins that experienced explosive growth over the last 12 months. These were generally well-known blockchain projects (not mere hype coins) that saw renewed investor interest, network growth, or positive news catalysts. Notable examples include:

-

Sui (SUI) – A newer smart-contract blockchain (seen as a “next-gen Solana”) that was the top-performing major token of 2024, soaring by ~509% that yeareconomictimes.indiatimes.com. SUI traded as low as ~$0.50 in mid-2024 and hit new highs around $4.78 by end of 2024economictimes.indiatimes.com, reflecting confidence in its technology and ecosystem growth.

-

Ripple (XRP) – The payment network token surged ~304% in 2024economictimes.indiatimes.com, fueled by broader adoption and a legal victory in its case with the SEC that clarified XRP’s status. XRP jumped from roughly ~$0.50 in mid-2024 to about $2.73 by early 2025economictimes.indiatimes.comeconomictimes.indiatimes.com, and by August 2025 it hovered near $3 (market cap ~$178 billion)zebpay.com. This established coin’s massive rally significantly boosted any portfolio holding it.

-

Hedera (HBAR) – The enterprise-focused hashgraph network’s token gained about +248% in 2024economictimes.indiatimes.com. Hedera benefited from growing corporate adoption of its network and was among the top performers, turning a mid-2024 price of around $0.05 into roughly $0.17+ by early 2025.

-

Stellar (XLM) – Another long-running payment blockchain (and a sibling to XRP) rose roughly +233% in 2024economictimes.indiatimes.com. Stellar’s price roughly tripled, reflecting increased usage in cross-border transfers and new partnerships.

-

Solana (SOL) – A major smart contract platform that had been depressed in 2022, roared back during 2024–2025. Solana’s price climbed from under ~$30 in mid-2024 to over $200 by August 2025zebpay.com. This is an over 6× gain for an established top-10 project, driven by Solana’s technical strengths (high throughput, low fees) and a resurgence of DeFi/NFT activity on its network. (Even though Solana’s year-over-year gain wasn’t number one in percentage terms, its large absolute rise contributed hugely to portfolio growth.)

-

Toncoin (TON) – The token of the TON blockchain (originating from Telegram’s project) rose about +155% in 2024binance.com. This reflected growing user adoption in its ecosystem. Similarly, TRON (TRX) – a platform known for stablecoin usage – gained roughly +155%economictimes.indiatimes.com over the year. Even established layer-1s like Cardano and Avalanche saw their prices roughly double to triple in this span, outpacing Bitcoin’s rise.

As shown above, many of the top 100 coins delivered triple-digit percentage returns over the last 12 months, significantly higher than Bitcoin’s ~136% or Ethereum’s more modest gains. Holding a broad basket meant all these winners were in the portfolio, delivering outsized returns. For instance, Ripple and Solana alone – both large-cap, non-meme assets – multiplied in value severalfold, which would have dramatically lifted an equal-weighted crypto portfolio. In contrast, a strategy limited only to Bitcoin/Ethereum would have missed these big alpha opportunities. Diversification ensured that the “next big thing” (whether a new chain like Sui or a comeback story like XRP or SOL) was included.

Enhancing Returns with Staking & LP Yields

Beyond just price appreciation, a savvy crypto investor could have further boosted returns via staking and liquidity provision (LP) income over the last year. Many established proof-of-stake blockchains reward holders with yield for helping secure the network. For example, staking Ethereum provided roughly 4–5% annual APY in this periodblocknative.com, paid in ETH. Other top chains like Cardano, Solana, and Avalanche similarly offered 5–10% staking yields, allowing investors to accumulate more coins on top of price gains. By staking a portion of their portfolio (or using liquid-staking tokens), an investor would organically grow their holdings during the year.

Investors could also deploy assets in decentralized finance (DeFi) to earn yield. Providing liquidity to trading pools or lending out tokens can generate significant interest and fee income. For instance, yields on relatively safe stablecoin pools ranged around 5% (low-risk) up to 15% APY (higher-risk DeFi) in 2024coinchange.io. Blue-chip DeFi platforms (like Uniswap, Aave, Curve, etc.) offered opportunities to earn trading fees or interest by contributing capital. An example strategy: one could provide an ETH–USDC pair on a DEX and earn swap fees and incentive rewards. While liquidity providing comes with risks (e.g. impermanent loss if one asset’s price moves sharply), during a broad upswing the volume and fees can make it lucrative. In 2024’s bull market, DeFi activity was high, so LPs earned healthy returns on top of asset price appreciation.

By combining HODLing with active yield strategies, our diversified investor would have maximized total return. Even an extra 5–10% yield on large holdings like ETH or stablecoins adds up meaningfully when the underlying assets themselves doubled or tripled in value. Crucially, all yield farming in this strategy would stick to established protocols and major tokens – avoiding the sketchy, high-APY meme coin farms. This aligns with the overall approach of balancing high returns with manageable risk.

Conclusion

In summary, a highly effective crypto investment strategy from August 2024 to August 2025 was to invest broadly across the top 100 established cryptocurrencies, equally weighting each. This approach captured the remarkable growth of fundamentally strong altcoins (which far outperformed Bitcoin’s gains) while mitigating the risk of betting on any single coin. The crypto market’s surge – driven by renewed mainstream optimism and network developments – lifted virtually all large-cap tokens, with many posting triple or quadruple-digit percentage returns over the year. An equal-spread portfolio would have enjoyed exceptional returns, thanks to big winners like SUI, XRP, Solana, and others contributing to the performance. Furthermore, by holding and staking those quality assets (and perhaps supplying liquidity in DeFi for additional yield), an investor could compound gains even more through earned rewardsblocknative.com.

This diversified, fundamentals-focused strategy (with no meme coins) proved ideal for the Aug 2024–Aug 2025 cycle. It balanced exposure across the crypto ecosystem’s leaders – from Bitcoin and Ethereum to rising networks – and leveraged both asset appreciation and DeFi yields. The result would have been a stellar overall return on the portfolio, significantly outpacing traditional markets and justifying the broad-based crypto approach. In essence, “don’t put all your eggs in one basket” rang especially true in crypto – spreading investments across strong, established tokens was the key to capturing the best returns in the past 12 months.

Sources: The performance figures and price milestones cited above are based on reputable market data and reports (e.g. Forbes/EconomicTimes and CoinMarketCap snapshots). For example, Forbes noted the top 2024 crypto gainers included SUI (+509%), XRP (+304%), and Hedera (+248%) among otherseconomictimes.indiatimes.comeconomictimes.indiatimes.com. Bitcoin’s 2024 climb past $100k (≈+136%) and total market stats were reported by CoinMarketCap/Forbeseconomictimes.indiatimes.combinance.com. Current prices as of Aug 25, 2025 (BTC ~$112k, SOL ~$204, etc.) are from market snapshotszebpay.comzebpay.com. Staking yield ranges (ETH ~4–5% APY) come from blockchain datablocknative.com, and DeFi yield rates (~15% on stablecoin pools) from industry researchcoinchange.io. These figures illustrate the strategy’s outcomes using real-world data.

Disclaimer: I do not provide investment, financial, or legal advice. The content here is for entertainment and general information only. I rely heavily on my own AI and research tools to explore ideas; they can be incomplete, incorrect, or change without notice. Cryptocurrency involves substantial risk, including the possible loss of principal. Past results and back-tests are not indicative of future performance. Always do your own research and consult a qualified financial adviser before making any investment decisions. Nothing here creates an adviser–client relationship, and I may hold positions in assets discussed.

-

10/11/2025 410

10/11/2025 410 -

08/27/2025 493

08/27/2025 493 -

08/27/2025 549

08/27/2025 549 -

08/27/2025 470

08/27/2025 470 -

08/18/2025 463

08/18/2025 463 -

05/30/2025 1010

05/30/2025 1010 -

03/24/2025 893

03/24/2025 893 -

03/24/2025 868

03/24/2025 868 -

03/24/2025 997

03/24/2025 997 -

03/22/2025 970

03/22/2025 970

-

06/10/2017 7611

06/10/2017 7611 -

06/19/2017 5786

06/19/2017 5786 -

06/28/2017 5103

06/28/2017 5103 -

07/12/2020 4278

07/12/2020 4278 -

07/17/2020 3825

07/17/2020 3825 -

05/01/2021 3249

05/01/2021 3249 -

01/07/2024 2400

01/07/2024 2400 -

11/28/2023 2349

11/28/2023 2349 -

02/16/2024 2190

02/16/2024 2190 -

11/20/2023 2154

11/20/2023 2154

FEATURED NEWS

GENERAL

GENERAL

THAILAND

BLOG

LEAVE A COMMENT